Feb 12, 2018 - What/where is the serial number on a National Insurance Number letter? To know where thr serial number will be located on the National Insurance letter as I. Nonton Naruto Vs Pain Sub Indo on this page. The official UK government definition of the NI number format. Contact HMRC if you haven't received your National Insurance. National Insurance number. The National Insurance number is a number used in the United Kingdom in the administration of the National Insurance or social security system. It is also used for some purposes in the UK tax system. The number is sometimes referred to as a NI No or NINO. This is an UK National Insurance Number validation tool, you can enter the appropriate value to get the verification results, for the convenience of use, the tool provides a generator, you can use the generator to test the results. The format of the NINO number is two prefix letters, six digits, and one suffix letter. Your National Insurance Number. However, details of all previous addresses in UK and a copy of the Home Office letter defining asylum status will be required. National Insurance Registrations will keep a record of the serial number of each form CA3530 issued and to whom it refers. Photocopies of the form are not acceptable.

A NINO is made up of 2 letters, 6 numbers and a final letter, which is always A, B, C, or D.

It looks something like this:

QQ 12 34 56 A

This is an example only and should not be used as an actual number.

Serial Number On Uk National Insurance Letters

The Prefix

Currently a prefix is chosen and then used until all the possible numbers have been allocated. Then another prefix is used, but not necessarily the next one alphabetically.

All prefixes are valid except:

- The characters D, F, I, Q, U, and V are not used as either the first or second letter of a NINO prefix.

- The letter O is not used as the second letter of a prefix.

- Prefixes BG, GB, KN, NK, NT, TN and ZZ are not to be used

The Suffix

The suffix dates back to when contributions were recorded on cards which were returned annually, staggered throughout the tax year. “A” meant the card was to be returned in March; “B” in June; “C” in September; and “D” in December. Although contribution cards are no longer used, the suffix has remained an integral part of the NINO.

Temporary Reference Number (TRN)

It is sometimes necessary to use a TRN for Individuals. The format of a TRN is 11 a1 11 11.

Cached

The TRN is an HMRC reference number which allows the individual to pay tax/NICs it is not a NINO. A TRN will not allow the customer to access benefits and other services which use the NINo. The individual will need to apply to DWP for a NINO

Administrative Numbers and Temporary Numbers (please note that Temporary Numbers are no longer used)

For administrative reasons, it has sometimes been necessary for HMRC and DWP to use reference numbers which look like NINOs but which do not use valid prefixes. The administrative prefixes used include:

OO

This “prefix” is used for temporarily administering Tax Credits where no NINO is held at the start of the tax credit claim. The customer should already have applied for a valid UK NINO.

FY

Previously used for Attendance Allowance claims

NC

Was used for Stakeholder Pensions, a scheme administrator may have allocated an in year dummy identifier beginning ‘NC’ followed by six numbers based on the date of birth and ending with ‘m’ or ‘f’ for the gender. This has not been used since 2005-2006.

PP

The PP999999P reference was used in past pension scheme reporting. This should no longer be used.

PZ

Former Inland Revenue processing used PZ and PY as administrative numbers from the 1970s for tax-only cases, but these have not been used since August 2002.

TN

These are Temporary Numbers which were used by employers and DWP when they did not know an individual’s NINO.

Employers are no longer permitted to use TN numbers and they will not be accepted by the Quality Standard. If the employer does not know an employee’s NINO when they submit their return, they should leave the NINO box blank, enter the employee’s date of birth and gender in the appropriate boxes, following the Employers’ Guidance, or on the HMRC internet site. See NIM39210.

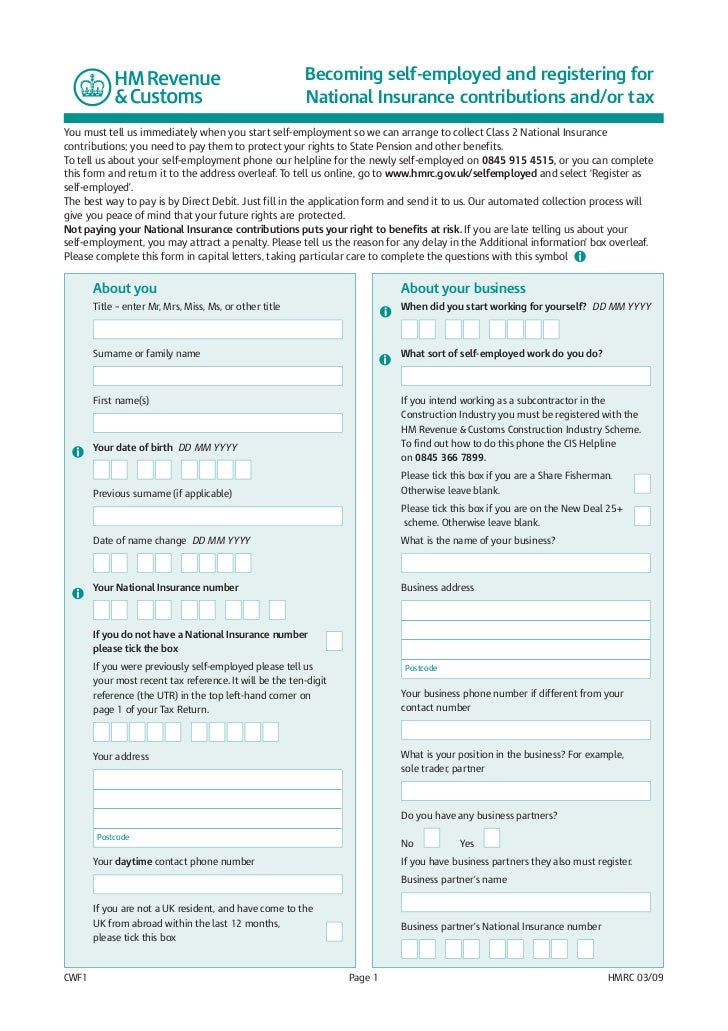

You will normally be sent a National Insurance (NI) number, which looks something like AB123456C, just before your 16th birthday.

You'll only ever be issued with one NI number, and it stays the same for life. It keeps a record of your National Insurance contributions, which over your working life can entitle you to some benefits and a state pension.

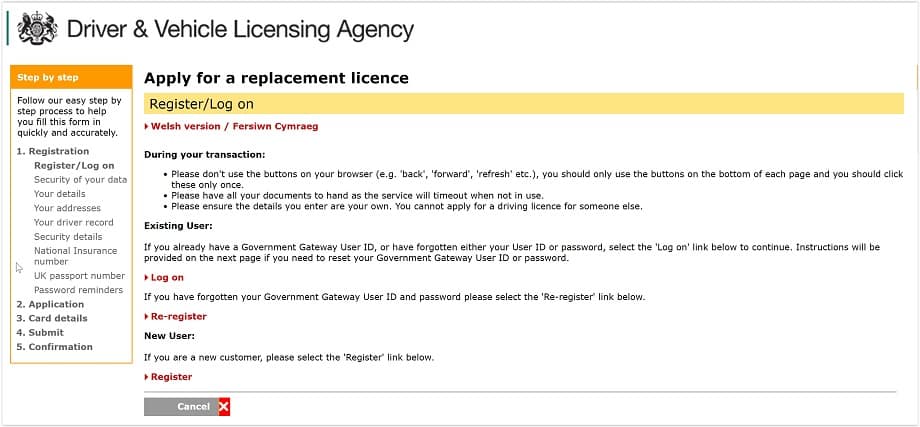

It's important to keep safe, like you do with other important personal data. Any new employer you have needs to know it, to pay in your contributions correctly. And you will need it if you want to talk to HMRC about tax and benefits, or when applying for things like a provisional driving licence, ISA savings account or student loan.

But if you've lost your NI number, it's not the end of the world. There are several ways to find it again:

Find it online

You can check your number using your online Personal tax account or on the HMRC App. When you go online you’ll be asked some questions to start with, to confirm who you are. Don’t worry if you can’t get into it on your first attempt, you can try again later. Once you’re in you can view, share or print a copy of your NI number confirmation letter.

Here's a quick HMRC video that shows you how to access it:

Look back through old records

What Is The Serial Number On A National Insurance Letter

You'll find your NI number on many documents you'll have received from your employer or HMRC. Check old payslips, P60s, or any letters about tax, pensions and benefits.

Request it by post

Complete an online form on the HMRC site and they'll post you your NI number again. There's also a HMRC phone line that can send your number by post if you would rather do that - see the National Insurance Number Helpline for more.

What Do The Letters At The Beginning And At The End Of My NI ...

Getting a number sent by post can take up to 15 days though, so don't leave it til the last minute!.

Serial Number On Uk National Insurance Letter Online

Be alert to scam companies that promise to provide your national insurance number online in return for a fee. Getting your national insurance number is free and it is issued by HMRC.